Frugality plays a pivotal role in achieving financial stability and independence. In a society that often emphasizes consumption and material wealth, the virtue of spending less can not only improve your financial situation but also transform your life. Here’s why frugality matters and how it can change your perspective on money and happiness.

The Problem with Comparison

In an article from The Atlantic, Joe Pinsker explored why many wealthy individuals are dissatisfied with their wealth. He identified two primary reasons:

- Hedonic Treadmill: People constantly seek to improve their situation, measuring happiness by whether they have more than they did before. Even those earning millions often feel they need two or three times as much to be happy.

- Social Comparison: People compare their possessions and success to others—family, friends, coworkers, or even fictional characters in movies and TV shows. This tendency to “keep up with the Joneses” drives dissatisfaction.

While these patterns may seem exclusive to the wealthy, they affect people across all income levels. Middle-class families, low-income individuals, and even those in poverty often feel the same pressures, compounded by unrealistic expectations perpetuated by media and entertainment.

This constant comparison leads to a desire for more—more money, more possessions, more prestige. But striving to keep up with others often results in financial stress and unhappiness.

The Power of Frugality

Frugality offers a way to break free from the comparison trap. It’s about shifting focus from what you lack to appreciating what you have and maximizing its value. For those pursuing financial independence or early retirement, frugality is often the cornerstone of their success.

By embracing a lifestyle of minimal consumption, you can:

- Reduce financial stress: Spending less lowers the amount you need to earn, making it easier to weather financial setbacks.

- Achieve financial goals faster: A frugal lifestyle creates a larger gap between income and expenses, allowing you to save and invest more.

- Simplify your life: Consuming less means less clutter, fewer obligations, and more freedom.

As Dominguez and Robin put it in their book Your Money or Your Life:

“Frugality is enjoying the virtue of getting good value for every minute of your life energy and from everything you have the use of.”

The Math Behind Frugality

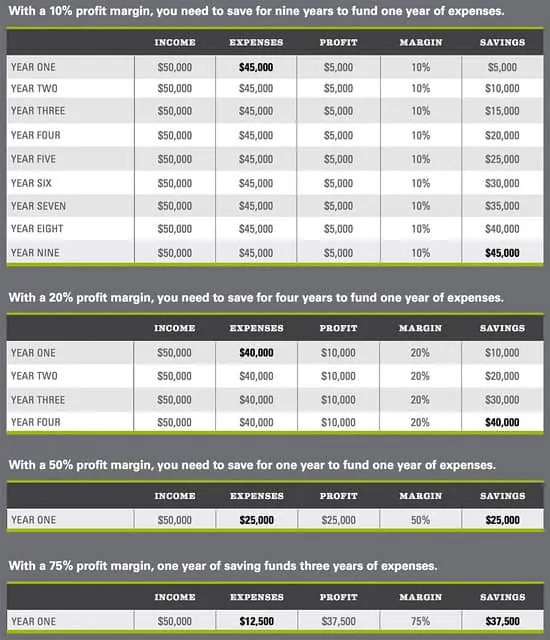

Frugality isn’t just a mindset; it’s a practical tool for financial growth. Consider the following:

- If you earn $50,000 annually and spend the same, you have no safety net. Losing your job would create an immediate crisis.

- If you reduce your spending to $25,000, you gain flexibility. Losing your job would be less catastrophic, as your lower expenses mean fewer resources are required to sustain you.

This simple shift also accelerates your ability to save. With a high savings rate of 50% or more, financial independence becomes attainable in your 30s or 40s instead of waiting until 65.

Frugality in Practice

Frugality isn’t about deprivation. It’s about making intentional choices that align with your values and long-term goals. Here are a few examples:

- Cooking at home: Instead of dining out, prepare meals yourself. It’s cheaper and often healthier.

- Driving older vehicles: Resist the urge to buy a new car. Well-maintained older models often work just as well.

- DIY projects: Handle minor home repairs and improvements yourself rather than hiring professionals.

- Shopping secondhand: Choose thrift stores and secondhand markets over new retail options.

- Entertainment alternatives: Host gatherings at home instead of meeting friends at expensive restaurants or events.

These small, intentional decisions can add up to significant savings over time.

Frugality’s Long-Term Benefits

The benefits of frugality go beyond finances. It can lead to:

- Greater freedom: By needing less, you’re not tied to a high-paying job or lifestyle.

- Increased resilience: A frugal mindset prepares you to handle financial setbacks without stress.

- Better relationships: With less focus on materialism, you can prioritize meaningful connections and experiences.

- A more sustainable future: Consuming less reduces your environmental footprint, benefiting both you and the planet.

A Personal Perspective

Like many others, I’ve struggled with the desire for more. I’ve been guilty of chasing material possessions and comparing myself to others. However, spending time with the financial independence (FI) community has shifted my mindset. Their emphasis on non-consumption and frugality has inspired me to make changes, such as:

- Opting for used items over new ones.

- Preparing meals at home.

- Repairing and reusing instead of replacing.

- Reducing unnecessary expenses, like cutting back on alcohol and subscription services.

These changes haven’t felt like sacrifices. Instead, they’ve empowered me to focus on what truly matters—relationships, personal growth, and freedom.

Final Thoughts

Frugality is more than a financial strategy; it’s a way of life that fosters contentment and resilience. By spending less, you gain more—more time, more freedom, and more peace of mind.

As Dominguez and Robin wrote:

“As you take your eyes off the false prize (of more, better, and different stuff), you put them on the real prizes: friends, family, sharing, caring, learning, meeting challenges, intimacy, rest, and being present.”

Choose frugality not as a form of deprivation but as a pathway to wealth, freedom, and happiness.